Response to Climate Change

It is evident that climate change requires urgent action. Whilst the Group has implicitly considered climate change factors in strategic decisions over the last number of years, it was recognised that this was required in a more formal and robust manner in FY2022. During the year, we strengthened our analysis of climate related matters, as well as our governance and reporting of them. This included strengthening our contributions and commitments to decarbonising our value chain as well as reviewing our strategies around climate risk management and adaptation.

Moreover, as part of our efforts to understand the impacts of climate change on our business, we have begun alignment towards the Task Force on Climate-related Financial Disclosures (“TCFD”) recommendations with the help of external consultants.

In accordance with LR 9.8.6R(8) and LR 9.8.7, we are required to include a statement in this Annual Report and Financial Statements setting out whether the Group has included climate-related financial disclosures consistent with the TCFD Recommendations and Recommended Disclosures (“TCFD Recommendations”). We have included climate-related financial disclosures in this Annual Report and Financial Statements consistent with the TCFD Recommendations, except for the following:

- Formally embedding climate-related risks and opportunities (“CROs”) within our strategy and financial planning through the use of quantitative scenario analysis (Recommendations Strategy (b) and (c))

- Identifying and monitoring metrics and targets aligned to all of the climate-related risks and opportunities that were identified as part of our qualitative scenario analysis (Recommendation Metrics & Targets (a) and (c)).

Our climate-related disclosures are set out below. This is the first year we have used the TCFD framework to support our reporting and we are committed to ensuring that we continue to improve our climate-related disclosures over the next year.

Governance

The Board is responsible for overseeing climate change risks and opportunities and considers climate-related issues when reviewing and guiding the Group’s strategy, as well as when undertaking any major plans of action or capital expenditure. C&C’s climate-related issues are also integrated into decisions regarding C&C’s annual budgets, business plans and performance objectives. The Group is committed to ensuring climate-related issues are considered when setting the Group’s risk management policies going forward, as discussed within the Risk Management section of this report on page 51.

Additionally, during the year, the Board has undertaken initial training on climate change related matters and the TCFD framework. A short list of CROs and the output of the scenario analysis conducted (see strategy section on page 47) were presented to the Board in March 2022. During the remaining months of 2022, we intend to carry out more extensive training on ESG and climate change as well as the associated risks and opportunities, in order to increase our leadership’s knowledge, understanding and awareness of climate related issues.

Elements of the Board’s oversight of climate change have been delegated to the ESG Committee which was established in September 2020. See page 107 of the ESG Committee report which contains its responsibilities and matters considered during the year. The Chair of the ESG Committee is responsible for providing the Board with an update around all ESG matters, including climate change. The ESG Committee is supported by a number of other Committees and Working Groups:

Risk & Compliance Committee: In our FY2021 Annual Report we included Sustainability and Climate Change as one of our principal risks. Therefore, in October of 2021 we established a Risk & Compliance Committee which is responsible for monitoring and managing this principal risk. This Committee is composed of executives and various levels of management from across the Group, and will meet bi-monthly. The Risk Committee for Sustainability and Climate Change reports to the Audit Committee; however, we are in the process of evaluating and developing additional reporting lines which will see the Risk Committee for Sustainability and Climate Change reporting also to the ESG Committee in order to improve C&C’s oversight of climate-related risks and opportunities.

ESG Working group: This is a core working group focused on initiating and overseeing projects related to ESG matters. Supporting the ESG working group are a number of ESG Champions across the business. The responsibilities of the Champion role focus on providing upward feedback on ESG initiatives to the ESG Committee.

We intend to roll out training on climate-related matters to key colleagues including ESG Champions and Procurement / Buying teams so that they will be able to contribute towards the update of risk registers and the identification of climate-related risks.

The Directors’ Remuneration Committee report on page 117 contains details on the ESG related metrics considered by the Committee. Specifically in relation to climate change, the following metrics are relevant:

Metric | Target | Relevant to |

Carbon reduction for the Group | The Group has set a target to reduce its Scope 1 emissions and Scope 2 emissions1 over the three financial years ending with FY2024 as follows: Threshold - 6% reduction Maximum - 12% reduction | Executive Directors |

1. Scope 1: direct emissions from owned or controlled sources, which includes emissions from Group-owned or operated facilities and vehicles.Scope 2: indirect emissions from the generation of purchased energy e.g. electricity, steam, heat and cooling.

Strategy

The Group has pledged to be a carbon-neutral business by 2050. We have grounded our emissions reduction targets in climate science through the Science Based Targets initiative (‘SBTi’), which will be validated by the end of 2023 at the latest as discussed on page 65 of the Responsibility Report.

Our Approach to Identifying Climate-related Risks and Opportunities.

In FY2022 we collaborated with external consultants to support us in identifying the Group’s CROs and to carry out a qualitative scenario analysis to understand the impact of the identified risks on our business. We completed various workshops involving our external consultants and a range of key stakeholders within C&C to consider potential CROs. Throughout this process, we utilised our existing Risk Management framework (as described on page 34 of the annual report) to assess the impact and the likelihood associated with each CRO. To take into consideration the longer term effects of climate change we redefined the Risk Time Frame.

The below time-horizons, which focus on when the identified CRO is likely to begin having a material impact on the business’ goals and objectives, were approved for use by the ESG Committee:

Time Frame | Description |

Short term | Present day to 2025 |

Medium Term | 2025 to 2030 |

Long term | 2030 to 2050 |

Our Identified CROs

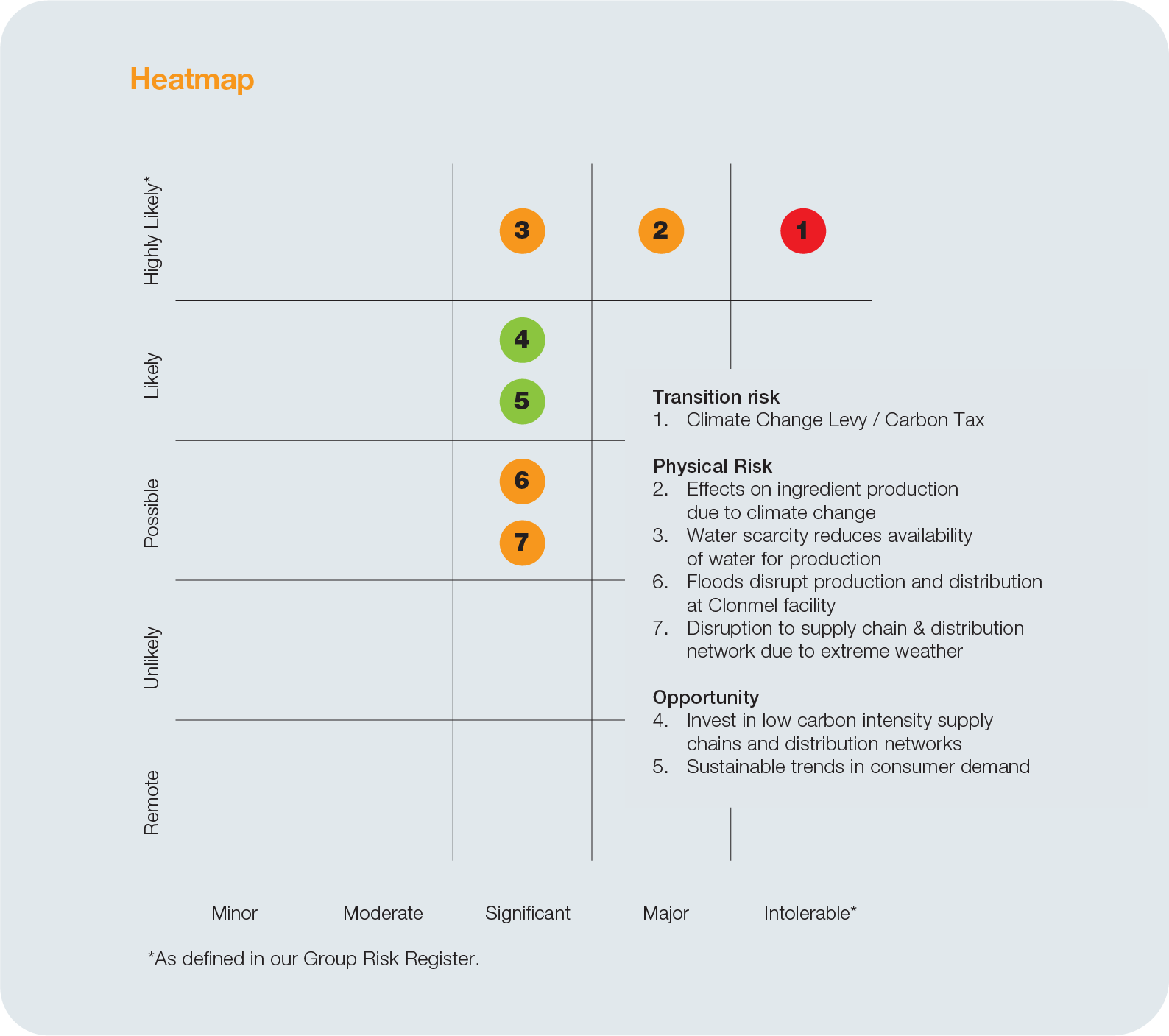

Using the process outlined above, we identified a “long list” of 38 CROs which was provided to the ESG Committee. We assigned each one a specific time horizon, impact level and likelihood and from this we prioritised 5 risks and 2 opportunities (“short list”) based on their overall rating.

Based on these shortlisted CROs, in FY2023 we will further develop additional targets and metrics that will allow us to manage these risks / leverage these opportunities, as well as measure our progress against them.

While the above represent the risks and opportunities that we have identified as being the most relevant to C&C at this time, we will continue to monitor the risks that we have identified as part of our long list and consider emerging CROs as new climate data and policies emerge. We expect this list to evolve over time. We also continue to actively monitor the changing landscape of sustainability reporting requirements to ensure that we are meeting the reporting expectations of our key stakeholders including regulators, investors and customers.

Understanding the impact on our CROs through Scenario Analysis

As part of our efforts to identify, assess, and mitigate climate-related risks and opportunities we have carried out a qualitative scenario analysis using the Representative Concentration Pathways (“RCP”) Scenarios published by the Intergovernmental Panel on Climate Change (“IPCC”). For our qualitative analysis, we used the IPCC RCP2.6 (to support our analysis of transition risks) and RCP8.5 (to support our analysis of physical risks) scenarios to assess the impact of different temperature increases on our short list of CROs.

Under the RCP2.6 scenario, the main risk for C&C will be the increase in climate change levies and taxes that would have to be introduced in most countries to be able to reduce GHG emissions. However, there are also opportunities for C&C to leverage under this scenario. We are trialling the use of electric vehicles and investigating the use of hydrogen vehicles within our car and truck fleets in order to decarbonise our supply chain and lower our exposure to carbon taxes.

Under the RCP8.5 scenario C&C would be primarily exposed to the risks of water scarcity, flooding and changing crop yields, all of which will impact our production.

The effects of the temperature scenarios on the shortlisted CROs and their impact, as well as C&C’s mitigation of these impacts, is summarised in the following table:

|

TCFD CRO Category |

Scenario |

Time Horizon |

Value Chain Impact and divisional impact |

Description of Impact prior to any mitigating activities being considered |

Management of risks and opportunities |

|

Transition risk - policy & legal Transition risk - technology |

RCP2.6 |

Short term |

Upstream, Production & distribution

Branded

Wholesale |

The Group’s primary production sites are located in geographical locations either with a Carbon Tax (Ireland) or Carbon Levy (UK). These costs are due to increase substantially between now and 2030. Moreover, the increased pricing of GHG emissions means that the Group’s operational costs will increase (e.g. heating). |

The Group will reduce our carbon emissions in line with our SBTi target. The Group will explore avenues to invest in low carbon intensity supply chains and in cleaner technologies. The Group will explore implementing a shadow carbon price in order to assess potential future financial impacts that could arise from proposed increases in carbon pricing. |

TCFD CRO Category

Transition risk

- policy & legal

Transition risk

- technology

Scenario

RCP2.6

Time Horizon

Short term

Value Chain Impact and divisional impact

Upstream, Production & distribution

Branded

Wholesale

Description of Impact prior to any mitigating activities being considered

The Group’s primary production sites are located in geographical locations either with a Carbon Tax (Ireland) or Carbon Levy (UK). These costs are due to increase substantially between now and 2030. Moreover, the increased pricing of GHG emissions means that the Group’s operational costs will increase (e.g. heating).

Management of risks and opportunities

The Group will reduce our carbon emissions in line with our SBTi target.

The Group will explore avenues to invest in low carbon intensity supply chains and in cleaner technologies.

The Group will explore implementing a shadow carbon price in order to assess potential future financial impacts that could arise from proposed increases in carbon pricing.

|

TCFD CRO Category |

Scenario |

Time Horizon |

Value Chain Impact and divisional impact |

Description of Impact prior to any mitigating activities being considered |

Management of risks and opportunities |

|

Physical risk - chronic |

RCP8.5 |

Long term |

Raw materials

Branded

Wholesale |

Changes in precipitation patterns and extreme variability in weather patterns will adversely affect barley, maize, wheat, malt, apple and apple juice, and wine production therefore affecting the Group’s supply chain and production capabilities. |

The Group will assess the climate related risk to each ingredient on an individual basis. The results will be incorporated into our supply chain strategy. |

TCFD CRO Category

Physical risk - chronic

Scenario

RCP8.5

Time Horizon

Long term

Value Chain Impact and divisional impact

Raw materials

Branded

Wholesale

Description of Impact prior to any mitigating activities being considered

Changes in precipitation patterns and extreme variability in weather patterns will adversely affect barley, maize, wheat, malt, apple and apple juice, and wine production therefore affecting the Group’s supply chain and production capabilities.

Management of risks and opportunities

The Group will assess the climate related risk to each ingredient on an individual basis. The results will be incorporated into our supply chain strategy.

|

TCFD CRO Category |

Scenario |

Time Horizon |

Value Chain Impact and divisional impact |

Description of Impact prior to any mitigating activities being considered |

Management of risks and opportunities |

|

Physical risk - chronic Transition risk - policy & legal |

RCP8.5 |

Long term |

Raw materials & Production

Branded

Wholesale |

Potential for long-term changes in ground water levels due to reduced precipitation may affect the availability of water for production (the Group uses water as both a product ingredient and as a plant cleaning medium) and enhances regulatory controls over seasonal water extraction activities, disrupting the Group’s production. |

Each of the Group’s sites has an active water management programme. This includes an ongoing assessment of the water scarcity risk to each production site. The Group will engage with our suppliers on their water management policies and establish if they have conducted a risk assessment which covers climate related water stress. |

TCFD CRO Category

Physical risk - chronic

Transition risk - policy & legal

Scenario

RCP8.5

Time Horizon

Long term

Value Chain Impact and divisional impact

Raw materials & Production

Branded

Wholesale

Description of Impact prior to any mitigating activities being considered

Potential for long-term changes in ground water levels due to reduced precipitation may affect the availability of water for production (the Group uses water as both a product ingredient and as a plant cleaning medium) and enhances regulatory controls over seasonal water extraction activities, disrupting the Group’s production.

Management of risks and opportunities

Each of the Group’s sites has an active water management programme. This includes an ongoing assessment of the water scarcity risk to each production site.

The Group will engage with our suppliers on their water management policies and establish if they have conducted a risk assessment which covers climate related water stress.

|

TCFD CRO Category |

Scenario |

Time Horizon |

Value Chain Impact and divisional impact |

Description of Impact prior to any mitigating activities being considered |

Management of risks and opportunities |

|

Physical risk - acute |

RCP8.5 |

Long term |

Production & Distribution

Branded |

Increased heavy precipitation leading to floods in Clonmel facility. The occurrence of flooding could also cause damage to property and halt production in these facilities, impacting outputs and revenue. |

As a significant employer in Tipperary in Ireland, the Group will work with the local authorities to foresee and mitigate any associated risk. A flood risk assessment will be conducted on the Clonmel site in Tipperary based on a RCP 8.5 scenario followed by the development of a flood management plan to minimise any potential business disruption. |

TCFD CRO Category

Physical risk - acute

Scenario

RCP8.5

Time Horizon

Long term

Value Chain Impact and divisional impact

Production & Distribution

Branded

Description of Impact prior to any mitigating activities being considered

Increased heavy precipitation leading to floods in Clonmel facility. The occurrence of flooding could also cause damage to property and halt production in these facilities, impacting outputs and revenue.

Management of risks and opportunities

As a significant employer in Tipperary in Ireland, the Group will work with the local authorities to foresee and mitigate any associated risk.

A flood risk assessment will be conducted on the Clonmel site in Tipperary based on a RCP 8.5 scenario followed by the development of a flood management plan to minimise any potential business disruption.

|

TCFD CRO Category |

Scenario |

Time Horizon |

Value Chain Impact and divisional impact |

Description of Impact prior to any mitigating activities being considered |

Management of risks and opportunities |

|

Physical risk - acute |

RCP8.5 |

Long term |

Upstream, Distribution

Branded

Wholesale |

Distribution channels are exposed to more extreme weather events leading to financial losses through lost revenue due to our suppliers being unable to deliver goods to us or the Group being unable to deliver goods to our customers. |

The Group will work with our partners in our recently launched Supply Chain engagement programme to review risks and mitigations on a longer term time horizon. The Group will mitigate the operational impact of extreme weather events through business continuity plans, which will be tested regularly against the latest IPCC scenarios. The Group will mitigate the financial impact of such events through business interruption insurance cover. |

TCFD CRO Category

Physical risk - acute

Scenario

RCP8.5

Time Horizon

Long term

Value Chain Impact and divisional impact

Upstream, Distribution

Branded

Wholesale

Description of Impact prior to any mitigating activities being considered

Distribution channels are exposed to more extreme weather events leading to financial losses through lost revenue due to our suppliers being unable to deliver goods to us or the Group being unable to deliver goods to our customers.

Management of risks and opportunities

The Group will work with our partners in our recently launched Supply Chain engagement programme to review risks and mitigations on a longer term time horizon.

The Group will mitigate the operational impact of extreme weather events through business continuity plans, which will be tested regularly against the latest IPCC scenarios.

The Group will mitigate the financial impact of such events through business interruption insurance cover.

|

TCFD CRO Category |

Scenario |

Time Horizon |

Value Chain Impact and divisional impact |

Description of Impact prior to any mitigating activities being considered |

Management of risks and opportunities |

|

Transition Opportunity (Resource Efficiency) |

RCP2.6 |

Long term |

Distribution

Branded

Wholesale |

Opportunity to mitigate the increase in production, transportation and distribution cost due to the increase in energy prices by transitioning to lower carbon options. This could allow the Group to lower costs with respect to our competitors. |

The Group will actively assess low carbon distribution options as the leading final mile delivery partner to the on trade in the UK and Ireland. The Group will work with our partners in our recently launched Supply Chain engagement programme to help them lower their carbon emissions. |

TCFD CRO Category

Transition Opportunity (Resource Efficiency)

Scenario

RCP2.6

Time Horizon

Long term

Value Chain Impact and divisional impact

Distribution

Branded

Wholesale

Description of Impact prior to any mitigating activities being considered

Opportunity to mitigate the increase in production, transportation and distribution cost due to the increase in energy prices by transitioning to lower carbon options. This could allow the Group to lower costs with respect to our competitors.

Management of risks and opportunities

The Group will actively assess low carbon distribution options as the leading final mile delivery partner to the on trade in the UK and Ireland.

The Group will work with our partners in our recently launched Supply Chain engagement programme to help them lower their carbon emissions.

|

TCFD CRO Category |

Scenario |

Time Horizon |

Value Chain Impact and divisional impact |

Description of Impact prior to any mitigating activities being considered |

Management of risks and opportunities |

|

Transition Opportunity (Resilience and Market) |

RCP2.6 |

Short term |

Sales & consumers

Branded |

Strong corporate climate change management enhances credibility and strengthens relationships with stakeholders leading to potential new revenue opportunities. Additionally, given that the Group’s production, distribution and crop sites are relatively close to each other, this could have a positive impact on carbon labelling and reputation as consumers increasingly look for locally sourced, low carbon products. |

The Group will continue to utilise in-house consumer insight via PROOF and external sources to develop / execute meaningful brand sustainability campaigns (Life is Bigger than Beer – Tennent’s and Save the Bees – Bulmers). |

TCFD CRO Category

Transition Opportunity (Resilience and Market)

Scenario

RCP2.6

Time Horizon

Short term

Value Chain Impact and divisional impact

Sales & consumers

Branded

Description of Impact prior to any mitigating activities being considered

Strong corporate climate change management enhances credibility and strengthens relationships with stakeholders leading to potential new revenue opportunities. Additionally, given that the Group’s production, distribution and crop sites are relatively close to each other, this could have a positive impact on carbon labelling and reputation as consumers increasingly look for locally sourced, low carbon products.

Management of risks and opportunities

The Group will continue to utilise in-house consumer insight via PROOF and external sources to develop / execute meaningful brand sustainability campaigns (Life is Bigger than Beer – Tennent’s and Save the Bees – Bulmers).

Risk Management

C&C adopts a standard risk management framework which is discussed in detail on page 34. We have in the past considered a wide range of risks and opportunities relating to climate change and other environmental factors that were evaluated by senior operational managers and technical specialists. These include, for example: impacts relating to continuity and cost of supply of raw materials, water, waste, energy use and efficiency, packaging materials, customer and consumer requirements, regulation as well as brand and reputational issues. However given the increasing focus on climate, in FY2022 we completed a deep dive on CROs as described in the strategy section above. We have integrated the results of this assessment into our overall risk management system. Therefore, the identification, prioritisation, assessment and management of our ‘Sustainability and Climate Change’ risk is completed in a manner consistent with the Group’s other principal risks with the exception of the timeframe used (please refer to the Strategy section of the TCFD report on page 47).

For additional information regarding the climate-related risks identified and our activities to mitigate these risks, please refer to the Strategy section of the TCFD report on page 47. Climate change mitigation is a current and ongoing responsibility for the Risk Committee for Sustainability and Climate Change as highlighted as part of the Governance section of this report on page 46.

To be able to better manage the projected impacts of climate change, we are committed to the continuous improvement of our processes for identifying and assessing our climate-related risks. We also want to improve the bottom-up risk assessment process and we will roll out education and awareness training that will be carried out an operational level to enhance our risk identification processes.

Any changes to climate-regulation, or the emergence of new climate-related regulation is considered as part of our normal regulation assessment for the Group.

Metrics & Targets

To oversee our progress against our Group’s climate-related goals and targets we have set a number of climate-related KPIs in line with our sustainability strategy. These KPIs have been selected in order to monitor our progress against our targets and to help us manage the identified CROs. The metrics adopted are monitored using a financial control boundary, and were developed in alignment with international environmental frameworks, namely CDP and SBTI, as well as with guidance provided by GHG Protocol.

The Board recognises the importance of ensuring that we monitor our performance with respect to the CROs identified with tailored KPIs. Currently, through the measurement of Scope 1, Scope 2 and Scope 3 emissions along with its SBTi commitment, the Group is able to manage CRO 1, Climate Change Levy / Carbon Tax. Additionally, through the monitoring of water usage in C&C’s facilities, the Group is able to manage CRO 3 - Water scarcity reduces availability of water for production - even though there is additional work to be done around the metrics to monitor suppliers in this area. The Group also measures performance and historical progress with respect to waste management (for more information, see page 70 in the Responsibility Report). We recognise that further work on metrics and targets aligning to the remaining CROs is required and are committed to working on this during the next financial year.

Areas of focus for FY2023

In FY2023 the Group will carry out a quantitative scenario analysis to support the formal embedding of CROs within our strategic planning. Moreover, it will allow the Group to further assess the financial impact of climate-related risks and opportunities on our business.

As we mature in our understanding of C&C’s climate-related issues and the impact on our business, we will also continue to reassess the short list as risks and opportunities evolve. We will integrate additional metrics and targets to support us in mitigating and managing the identified risks and opportunities.

TCFD Index

Disclosure Requirement | TCFD disclosure met | Page Reference | Actions Undertaken | Next Steps |

(a) Describe the board’s oversight of climate-related risks and opportunities. | Yes |

|

| |

(b) Describe management’s role in assessing and managing climate-related risks and opportunities. | Yes |

Disclosure Requirement

(a) Describe the board’s oversight of climate-related risks and opportunities.

TCFD disclosure met

Yes

Page Reference

Page 46

Actions Undertaken

- A Risk & Compliance Committee was established in order to monitor and manage Sustainability and Climate Change as a principal risk.

- The Board received initial training on climate change and TCFD reporting.

Next Steps

- Carry out further training on ESG and climate change as well as the associated risks and opportunities.

- Develop additional reporting lines which will see the Risk Committee for Sustainability and Climate Change reporting also to the ESG Committee.

Disclosure Requirement

(b) Describe management’s role in assessing and managing climate-related risks and opportunities.

TCFD disclosure met

Yes

Page Reference

Pages 46 - 47

Actions Undertaken

- A Risk & Compliance Committee was established in order to monitor and manage Sustainability and Climate Change as a principal risk.

- The Board received initial training on climate change and TCFD reporting.

Next Steps

- Carry out further training on ESG and climate change as well as the associated risks and opportunities.

- Develop additional reporting lines which will see the Risk Committee for Sustainability and Climate Change reporting also to the ESG Committee.

Disclosure Requirement | TCFD disclosure met | Page Reference | Actions Undertaken | Next Steps |

(a) Describe the climate-related risks and opportunities the organisation has identified over the short, medium, and long term. | Yes |

|

| |

(b) Describe the impact of climate-related risks and opportunities on the organisation’s businesses, strategy, and financial planning. | No | - | ||

(c) Describe the resilience of the organisation’s strategy, taking into consideration different climate-related scenarios, including a 2°C or lower scenario. | Partially |

Disclosure Requirement

(a) Describe the climate-related risks and opportunities the organisation has identified over the short, medium, and long term.

TCFD disclosure met

Yes

Page Reference

Pages 49 - 51

Actions Undertaken

- Identified climate risks and opportunities that could have a material impact on C&C.

- Conducted a detailed qualitative climate change risk assessment and scenario analysis with the support of an expert external party.

Next Steps

- Continue to monitor the risks that we have identified and consider emerging CROs as new climate data and policies emerge.

- Actively monitor the changing landscape of sustainability reporting requirements.

- Carry out a quantitative scenario analysis to assess the financial impact of climate-related risks and opportunities on C&C and integrate climate change within C&C’s strategy and financial planning.

Disclosure Requirement

(b) Describe the impact of climate-related risks and opportunities on the organisation’s businesses, strategy, and financial planning.

TCFD disclosure met

No

Page Reference

-

Actions Undertaken

- Identified climate risks and opportunities that could have a material impact on C&C.

- Conducted a detailed qualitative climate change risk assessment and scenario analysis with the support of an expert external party.

Next Steps

- Continue to monitor the risks that we have identified and consider emerging CROs as new climate data and policies emerge.

- Actively monitor the changing landscape of sustainability reporting requirements.

- Carry out a quantitative scenario analysis to assess the financial impact of climate-related risks and opportunities on C&C and integrate climate change within C&C’s strategy and financial planning.

Disclosure Requirement

(c) Describe the resilience of the organisation’s strategy, taking into consideration different climate-related scenarios, including a 2°C or lower scenario.

TCFD disclosure met

Partially

Page Reference

Pages 47 - 48

Actions Undertaken

- Identified climate risks and opportunities that could have a material impact on C&C.

- Conducted a detailed qualitative climate change risk assessment and scenario analysis with the support of an expert external party.

Next Steps

- Continue to monitor the risks that we have identified and consider emerging CROs as new climate data and policies emerge.

- Actively monitor the changing landscape of sustainability reporting requirements.

- Carry out a quantitative scenario analysis to assess the financial impact of climate-related risks and opportunities on C&C and integrate climate change within C&C’s strategy and financial planning.

Disclosure Requirement | TCFD disclosure met | Page Reference | Actions Undertaken | Next Steps |

(a) Describe the organisation’s processes for identifying and assessing climate-related risks. | Yes |

|

| |

(b) Describe the organisation’s processes for managing climate-related risks. | Yes | |||

(c) Describe how processes for identifying, assessing, and managing climate-related risks are integrated into the organisation’s overall risk management. | Yes |

Disclosure Requirement

(a) Describe the organisation’s processes for identifying and assessing climate-related risks.

TCFD disclosure met

Yes

Page Reference

Page 51

Actions Undertaken

- Further integrated climate-related risks within C&C’s overall risk management process.

Next Steps

- C&C will further develop the bottom-up risk assessment process relevant to CROs.

- Roll out education and awareness training that will be carried out an operational level to enhance the Group’s risk identification processes.

Disclosure Requirement

(b) Describe the organisation’s processes for managing climate-related risks.

TCFD disclosure met

Yes

Page Reference

Pages 46 and 51

Actions Undertaken

- Further integrated climate-related risks within C&C’s overall risk management process.

Next Steps

- C&C will further develop the bottom-up risk assessment process relevant to CROs.

- Roll out education and awareness training that will be carried out an operational level to enhance the Group’s risk identification processes.

Disclosure Requirement

(c) Describe how processes for identifying, assessing, and managing climate-related risks are integrated into the organisation’s overall risk management.

TCFD disclosure met

Yes

Page Reference

Page 51

Actions Undertaken

- Further integrated climate-related risks within C&C’s overall risk management process.

Next Steps

- C&C will further develop the bottom-up risk assessment process relevant to CROs.

- Roll out education and awareness training that will be carried out an operational level to enhance the Group’s risk identification processes.

Disclosure Requirement | TCFD disclosure met | Page Reference | Actions Undertaken | Next Steps |

(a) Disclose the metrics used by the organisation to assess climate-related risks and opportunities in line with its strategy and risk management process. | Partially |

|

| |

(b) Disclose Scope 1, Scope 2, and, if appropriate, Scope 3 greenhouse gas (GHG) emissions, and the related risks. | Yes | |||

(c) Describe the targets used by the organisation to manage climate related risks and opportunities and performance against targets. | Partially |

Disclosure Requirement

(a) Disclose the metrics used by the organisation to assess climate-related risks and opportunities in line with its strategy and risk management process.

TCFD disclosure met

Partially

Page Reference

Page 47 and 52

Actions Undertaken

- Set carbon reduction targets in line with SBTi.

- Assessed our current metrics in relation to the identified CROs.

Next Steps

- Evaluate and develop, where applicable, additional metrics and targets to support us in managing the identified climate-related risks and opportunities.

- Achieve our SBTi objectives.

Disclosure Requirement

(b) Disclose Scope 1, Scope 2, and, if appropriate, Scope 3 greenhouse gas (GHG) emissions, and the related risks.

TCFD disclosure met

Yes

Page Reference

Page 66

Actions Undertaken

- Set carbon reduction targets in line with SBTi.

- Assessed our current metrics in relation to the identified CROs.

Next Steps

- Evaluate and develop, where applicable, additional metrics and targets to support us in managing the identified climate-related risks and opportunities.

- Achieve our SBTi objectives.

Disclosure Requirement

(c) Describe the targets used by the organisation to manage climate related risks and opportunities and performance against targets.

TCFD disclosure met

Partially

Page Reference

Page 47 and 52

Actions Undertaken

- Set carbon reduction targets in line with SBTi.

- Assessed our current metrics in relation to the identified CROs.

Next Steps

- Evaluate and develop, where applicable, additional metrics and targets to support us in managing the identified climate-related risks and opportunities.

- Achieve our SBTi objectives.